-

TRADE FINANCE COMPLIANCE

February 2026

UK OFSI tightens sanctions enforcement playbook with Early Account Scheme and new breach grading

The UK’s Office of Financial Sanctions Implementation (OFSI) has refreshed its Financial Sanctions Enforcement and Monetary Penalties Guidance, unveiling an Early Account Scheme (EAS) and a revised case assessment approach intended to bring more structure and transparency to outcomes for organisations exposed to cross-border payments, trade flows and related services.

-

TRADE FINANCE

February 2026

ITFA Report - The Range of Approaches to Price Verification in Trade Finance

The paper explores the role of price verification in combating trade-based money laundering (TBML), highlighting real-world fraud examples and emphasising that while price screening remains important, there is no single prescriptive approach. Institutions are encouraged to calibrate controls to their specific risk exposure and embed price verification within a broader TBML framework.

-

Trade Finance

February 2026

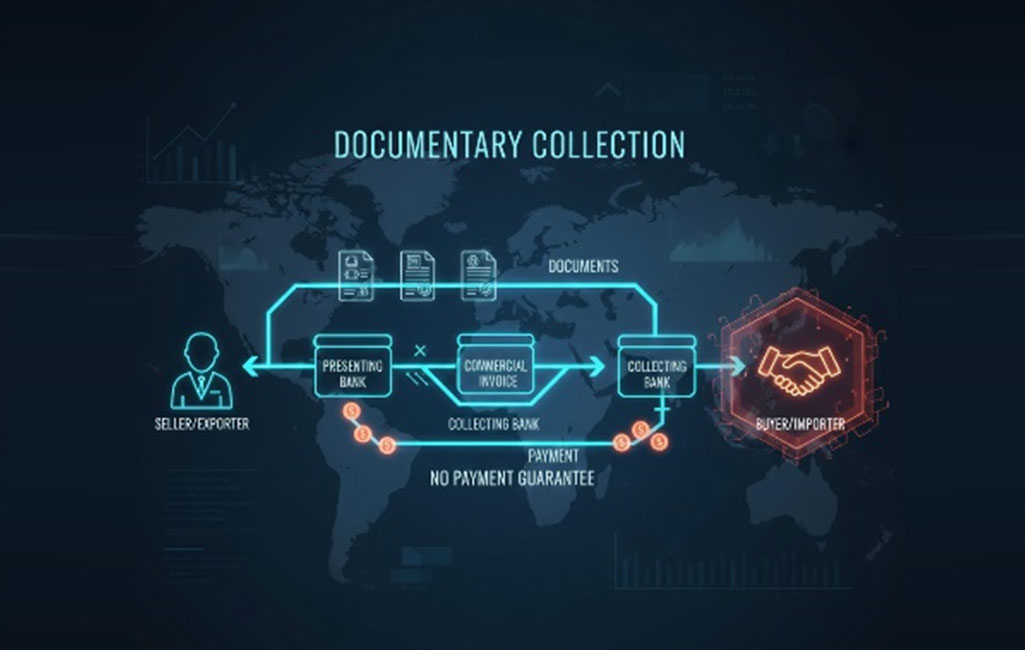

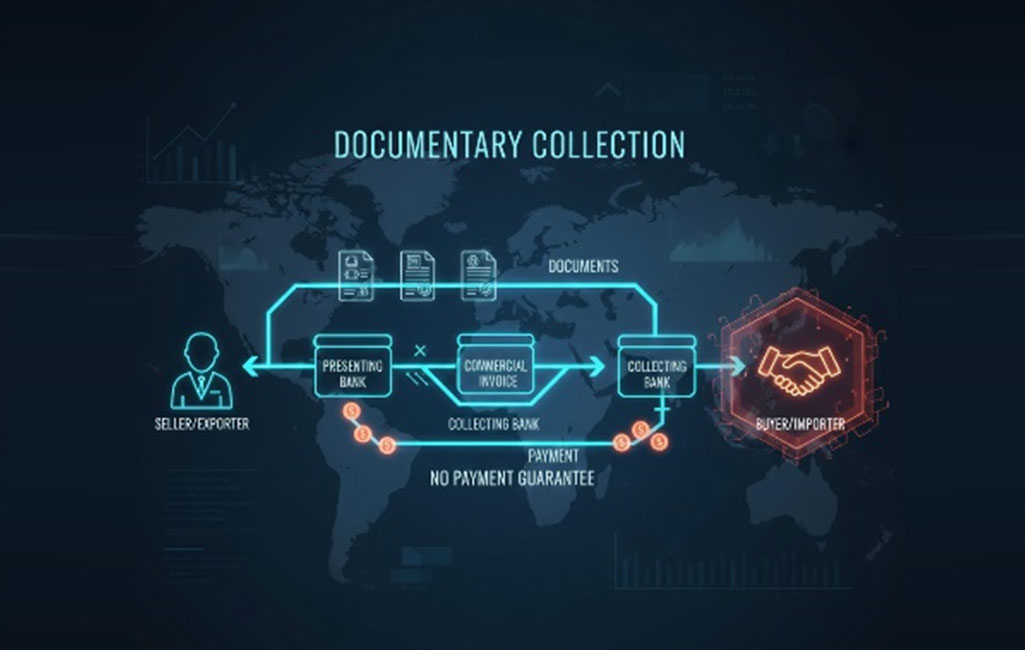

A Documentary Collection URC522

A documentary collection is a method of payment used in international trade where the seller (exporter) instructs their bank to collect payment from the buyer (importer) in exchange for the necessary shipping and title documents. The banks act only as collection agents and do not guarantee payment. This method is simpler and generally cheaper than a Letter of Credit, but offers the seller less security, as the buyer can simply refuse to pay and the goods remain stuck at the port.

-

TRADE FINANCE COMPLIANCE

February 2026

Technology/AI practical applications in SBLCs & Guarantees.

-

Sustainability

February 2026

Why do environmental and social issues matter for banks?

-

Trade Finance

February 2026

Crossword

Test you knowledge on Trade Finance.

-

TRADE FINANCE COMPLIANCE

January 2026

France seizes nearly €1 billion in Russian oligarch asset

Paris | January 16, 2026 — French authorities have provisionally seized nearly €973 million in assets linked to Russian oligarchs since the start of the war in Ukraine, according to data released by the Paris prosecutor’s office and reported by Le Monde. The seizures form part of France’s broader efforts to enforce financial crime laws and implement sanctions targeting individuals close to the Russian government.

-

Trade Finance Compliance

January 2026

Recent Compliance Publications 2025

- FATF Recommendations (updated 2025) – Read More

- FATF Methodology for Assessing Technical Compliance & Effectiveness (updated Oct 2025) – Read More

- The Wolfsberg Group – Statement on the Risk-Based Approach (July 2025) – Read More

- The Wolfsberg Statement on Effective Monitoring for Suspicious Activity, Part II (Transitioning to Innovation) – Read More

- HMRC– Trade-Based Money Laundering (TBML) handbook (October 2025) – Read More

-

Trade Finance Compliance

January 2026

Sanctions - Guidance for Shipping and Maritime stakeholders

Combatting trade based financial crimes

- OFAC – April 2025 - Guidance for Shipping and Maritime Stakeholders on Detecting and Mitigating Iranian Oil Sanctions Evasion

- OFSI – March 2025 - Financial Sanctions Guidance for Maritime Shipping

- OFAC – 2020 - Guidance to Address Illicit Shipping and Sanctions Evasion Practices

-

TRADE FINANCE COMPLIANCE

January 2026

TRM Labs: Iran’s IRGC moved nearly $1 Billion through UK-Registered Crypto Exchanges

Blockchain intelligence firm TRM Labs has reported that Iran’s Islamic Revolutionary Guard Corps (IRGC) moved nearly $1 billion in cryptocurrency through two cryptocurrency exchanges registered in the United Kingdom—Zedcex and Zedxion—between 2023 and 2025.

-

TRADE FINANCE COMPLIANCE

January 2026

Central Banks enter Gold Trade to stem illicit export flows

Madagascar and Ghana, alongside countries such as Ecuador and Mongolia are increasing direct involvement in domestic gold markets to address persistent smuggling and undeclared exports, according to a report published by the Financial Times on January 1, 2026.

-

Trade Finance

January 2026

Crossword

Test you knowledge on Trade Finance.

-

Trade Finance

January 2026

ICC Opinions

ICC Opinions are the official interpretations and rulings ...

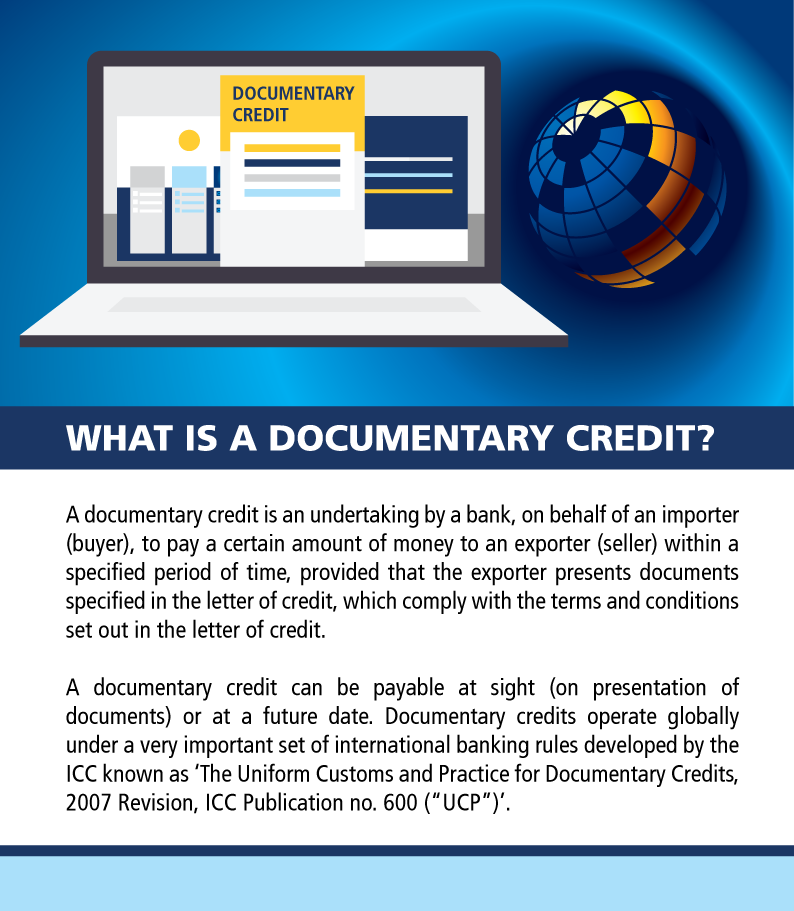

ICC Opinions are the official interpretations and rulings issued by the ICC Banking Commission (International Chamber of Commerce) on the application of its globally recognized trade finance rules, such as the UCP 600 (for Letters of Credit) or URC 522 (for Documentary Collections).

The primary purpose of an Opinion is to clarify ambiguities, settle specific disputes, and ensure uniformity of practice in international trade finance documentation and processes worldwide. While these Opinions are not legally binding, they are highly persuasive and are widely followed by banks, trade practitioners, lawyers, and often cited by courts as authoritative interpretations of International Standard Banking Practice (ISBP).

-

Trade Finance

January 2026

ISO 20022

ISO 20022 messages are a global standard for financial messaging, creating a common, data-rich language for transactions between financial institutions and their customers.

This standard is replacing older, less consistent messaging formats to enable more consistent, accurate, and efficient payment processes, including instant payments.

The messages are built on a common model of financial business concepts and can be represented in different syntax formats like XML.

-

Trade Finance compliance

January 2026

A Phantom Shipment

A "phantom shipment" refers to a transaction where documents are created for goods that are never actually shipped or even exist. It's a way to move money under the guise of legitimate trade.

-

Trade Finance compliance

January 2026

Common Shipping and Maritime Evasion Practices

Regulatory guidance consistently identifies the following deceptive shipping practice (DSP) that must be guarded against:

- False Flags or Flag Hopping: A vessel misrepresenting its operating flag or repeatedly changing flags to avoid detection.

- Ship-to-Ship (STS) Transfers: The transfer of goods between vessels at sea. While legitimate, analysis must focus on high-risk jurisdictions and/or unusual timing.

- Complex Ownership Structures: Designed to mask the ultimate beneficial owners (UBOs) to avoid sanctions or other scrutiny.

- False or Fraudulent Documentation: Altering or falsifying documents to disguise a sanctions element (e.g., misrepresenting cargo origin or destination).

- Manipulation of Vessel Identification and Navigational Data: Tactics such as disabling or manipulating the Automatic Identification System (AIS) to mask vessel movements and true locations.

-

Trade Finance compliance

January 2026

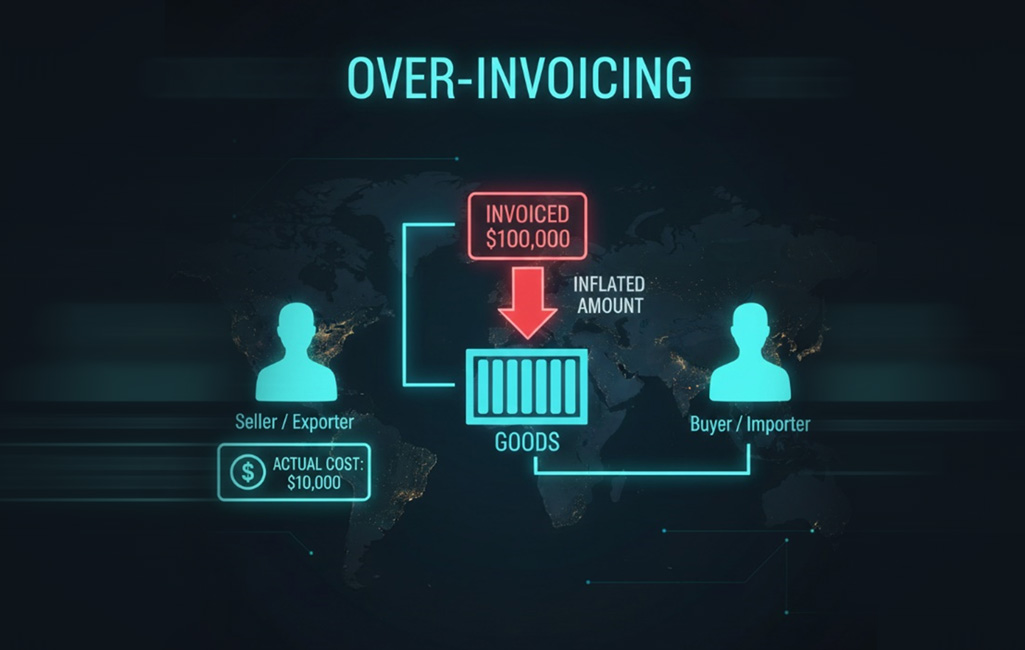

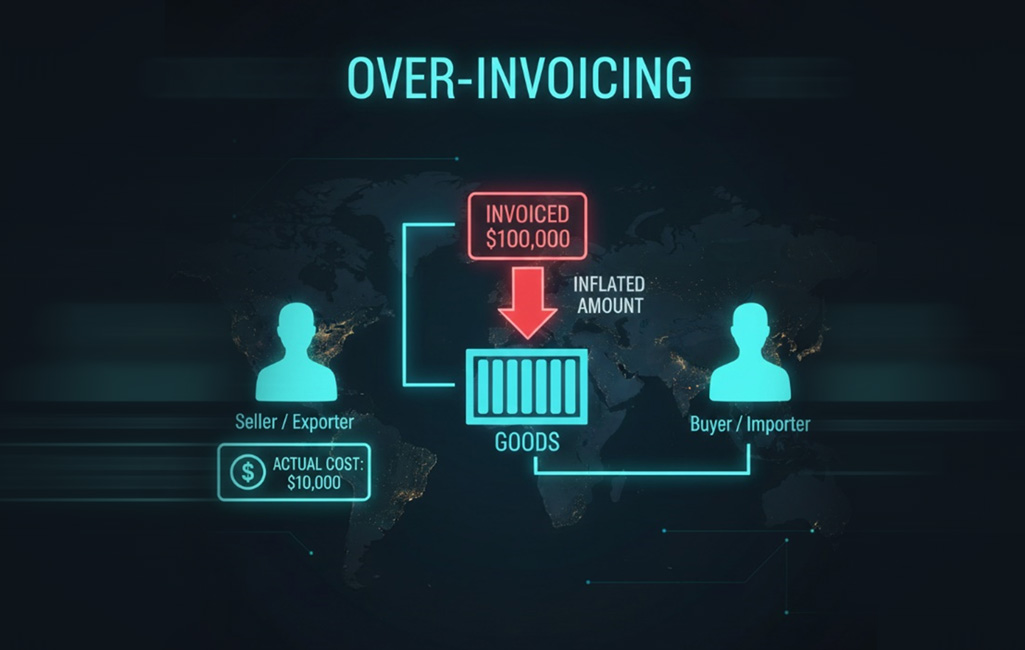

Over-Invoicing

Over-invoicing is a fraudulent practice where the seller (exporter) issues an invoice to the buyer (importer) for a price that is significantly higher than the actual value, quality, or quantity of the goods shipped.

The primary goal of over-invoicing is to facilitate the illegal transfer of funds out of a country, often for the purpose of money laundering or capital flight (moving wealth out of a country to avoid taxes or currency controls). By inflating the price on paper, the buyer is justified in transferring more money abroad through the formal banking system than is actually required for the trade.

-

Trade Finance compliance

December 2025

Guidance Papers

Sanctions - Guidance for Shipping and Maritime stakeholders

Combatting trade based financial crimes

OFAC – April 2025 - Guidance for Shipping and Maritime Stakeholders on Detecting and Mitigating Iranian Oil Sanctions Evasion

OFSI – March 2025 - Financial Sanctions Guidance for Maritime Shipping

OFAC – 2020 - Guidance to Address Illicit Shipping and Sanctions Evasion Practices

-

Trade Finance compliance

December 2025

Recent Compliance Publications

FATF and The Wolfsberg Group

FATF Recommendations (updated 2025)

Read More FATF Methodology for Assessing Technical Compliance & Effectiveness (updated Oct 2025)

Read More The Wolfsberg Group – Statement on the Risk-Based Approach (July 2025)

Read More The Wolfsberg Statement on Effective Monitoring for Suspicious Activity, Part II (Transitioning to Innovation)

Read More HMRC – Trade-Based Money Laundering (TBML) handbook (October 2025) Read More -

TRADE FINANCE COMPLIANCE

December 2025

China sanctions U.S. Defence firms over Taiwan arms sale

China’s Ministry of Foreign Affairs announced countermeasures against 20 U.S. defence-related companies and 10 individuals, after Washington unveiled a proposed Taiwan arms package reported at about $11.1 billion (more than $10 billion).

-

Trade Finance

December 2025

Guess the word

Hint: Another name for a Documentary Credit

-

Trade Finance compliance

December 2025

UK - New "failure to prevent fraud" law

The UK's new "Failure to Prevent Fraud" offence, enacted under the Economic Crime and Corporate Transparency Act 2023, came into force on September 1, 2025.

The UK's new "Failure to Prevent Fraud" offence, enacted under the Economic Crime and Corporate Transparency Act 2023, came into force on September 1, 2025.

This law means that a large organisation can be held criminally liable if an employee or agent commits a fraud intended to benefit the organisation, regardless of whether senior management was aware of it.

The only defence against this liability is for the organisation to prove it had "reasonable fraud prevention procedures" in place.

It shifts the burden onto businesses to proactively implement robust anti-fraud measures. This is a significant change in corporate liability.

-

Sustainability in Trade and Trade Finance

December 2025

Greenwashing

-

TRADE FINANCE COMPLIANCE

December 2025

U.S. grants Reliance one-month permission to continue Rosneft Oil Receipts

December 24, 2025 — The United States has granted India’s Reliance Industries special permission for one month to keep receiving crude oil cargoes supplied by Russia’s Rosneft, according to sources cited by Reuters.

-

TRADE FINANCE COMPLIANCE

November 2025

EU urged to consider tanker transport ban as Russian ‘shadow fleet’ undermines oil price cap

Brussels, 24 November 2025 – European policymakers are being urged to tighten sanctions enforcement on Russian oil exports by replacing the current G7 price-cap mechanism with a full transport ban on tankers carrying Russian crude and products, in a move aimed at dismantling the so-called “shadow fleet” and closing persistent paperwork fraud loopholes.

-

Trade Finance

November 2025

Drafts & UCP 600

-

Trade Finance Compliance

November 2025

Guess the word

Hint: A document accompanying goods indicating the country where the goods were produced.

-

TRADE FINANCE COMPLIANCE

November 2025

UK authorities expose multi-billion-dollar laundering network aiding Russian sanctions evasion

On 21 November 2025, the UK’s National Crime Agency (NCA) disclosed new findings from “Operation Destabilise”, an international investigation into multi-billion-dollar Russian-linked money-laundering networks that connect criminal cash collected in Britain to Russian state-linked interests.

The network has been tied to efforts to secretly channel funds in support of Russia’s war in Ukraine while evading Western sanctions.

-

TRADE FINANCE COMPLIANCE

October 2025

U.S. sanctions China linked firms in Iran Oil Network

14 October 2025 — Washington, D.C. — On 9 October, the U.S. Department of the Treasury announced sanctions on roughly 100 individuals, entities, and vessels for facilitating Iran’s oil and petrochemical trade through so-called “shadow fleet” supply chains.

The Office of Foreign Assets Control (OFAC) included among the designees Shandong Jincheng Petrochemical Group Co., an independent “teapot” refinery in China, and Rizhao Shihua Crude Oil Terminal Co., a terminal at Lanshan Port that accepted multiple Iranian oil tankers.

-

TRADE FINANCE COMPLIANCE

October 2025

Europe sees rise in suspected food trade fraud and non-compliance alerts

BRUSSELS, 21 October 2025 – European authorities registered a marked increase in suspected fraud and regulatory non-compliance cases across the food and beverage trade sector in August 2025, according to the latest data from the EU’s Rapid Alert System for Food and Feed (RASFF).

The monthly report, compiled by the European Commission’s Directorate-General for Health and Food Safety, noted that fraud-related alerts increased compared to July, with the majority involving product mislabelling, origin falsification, and improper documentation in cross-border shipments. Several alerts involved imports from non-EU countries and centered on goods such as olive oil, seafood, spices, and processed meats.

-

SUSTAINABILITY

October 2024

UN Sustainable Development Goals (UN SDGs)

In 2015, heads of government adopted the UN Sustainable Development Goals (SDGs) which came into effect in 2016. The SDGs are presented in the UN report "Transforming our World: The 2030 Agenda for Sustainable Development".

-

Trade Finance

October 2025

Guess the word

Hint: A method of resolving commercial disputes where both parties are required to submit the documents relevant to the case to an outside agency for an independent judgement and to accept that judgement.

-

Sustainability

September 2025

Water Resources

As the world population expands, so does the need for fresh water and safe drinking water supplies. Understanding the water footprint of a product and being able to substitute different types (qualities) of water used in the production of that product contributes towards conserving the natural resources.

The Oil, Paper and Fashion industries are the largest consumers of water globally.

The table below shows the typical volume of water needed to produce a unit of everyday produce.

Commodity (Kg) Volume of water

required (Litres)Tobacco 2,925 Beef 16,000 Potatoes 287 Wine(litre) 870 1 cup of coffee 140 -

Trade Finance

September 2025

Guess the word

Hint: The bank's opposite number in a financial transaction. The individual/institution on the opposite side of a financial transaction; the other party to a contract.

-

Sustainability

August 2025

History of Greenwashing

Examples of “greenwashing” first occurred in the 1960s when companies were making efforts to improve their public image considering the emerging environmental movement. The concept of greenwashing first appeared in the early 1970s when oil companies launched campaigns to counter claims that they were harming the planet. The term “greenwashing” was the idea of an American environmentalist Jay Weterveld in 1983 when he read a note in a hotel in Fiji asking guests to re-use towels to save the environment and ecosystem of Fiji, claiming that it was a company water conservation strategy, although at this time the hotel was expanding into local ecosystems.

-

Trade Finance compliance

August 2025

Indicators of Trade Based Financial Crimes

There are widely accepted Indicators of financial crime that suggest the possibility of various types of financial crime.

Typical Indicators include:

- Unusual Transaction

- Significant Deviations in Business Patterns

- Collusion

- Apparent Front or Shell Company in Transaction

- Geographical or Jurisdictional Concerns

- Transactions in High Risk or High Value Goods

- Problematic Parties

- Dual Use Goods

- Apparent Inconsistencies in Proposed Transaction

- Trade Structure Concerns

- Letter of Credit Related Concerns

- Suspicious Actions

-

TRADE FINANCE

August 2025

Latest Technical Advisory Briefings

Technical Advisory Briefings from the ICC Banking Commission.

Latest Technical Advisory Briefings #13 - Confirmation of a documentary credit under UCP 600 and #14 - Procedure for payment is now available under the Digital Library.

View the briefing -

Trade Finance

July 2025

Crossword

Test you knowledge on Trade Finance.

-

Trade Finance

July 2025

What is a Clean Standby LC?

A clean standby is an undertaking to pay on presentation of a simple demand or draft without any reference to the occasion for drawing it.

Due to the simplicity of its requirements - merely a demand or a draft - a clean standby is sometimes known colloquially as a “suicide standby”.

-

Trade Finance Compliance

June 2025

What is Money Laundering

Money laundering is the criminal practice of processing illegally obtained money by placing it into legitimate finance in order to make it appear as though it were derived from legitimate activities.

FATF defines trade based money laundering as:

“the process of disguising the proceeds of crime and moving value through the use of trade transactions in an attempt to legitimise their illicit origin.”

-

SUSTAINABILITY

June 2025

Changing Global Climate

There is common scientific consensus that the global average temperature is rising at an un-precedented rate.

-

Sustainability

June 2025

What is Greenwashing?

Greenwashing is defined “as activities by a company or an organization that are intended to make people think that it is concerned about the environment, even if its real business actually harms the environment”.

Source: Oxford English Dictionary

Greenwashing is designed “to make people believe that your company is doing more to protect the environment than it really is”.

Source: Cambridge Dictionary

-

Trade Finance Compliance

June 2025

What are phantom shipments?

Phantom shipments are when the seller invoices the buyer for goods that are not sent./p>

-

TRADE FINANCE COMPLIANCE

June 2025

When does Commercial Fraud Occur?

Commercial Fraud occurs where legitimate commercial activities are misused for improper and illegitimate ends.

Find out more -

Trade Finance

June 2025

Crossword

Test you knowledge on Trade Finance.

-

TRADE FINANCE COMPLIANCE

May 2025

Inter-American Development Bank and Interpol partner to tackle regional TBML

The Inter-American Development Bank (IDB) and Interpol have formalised a new partnership aimed at enhancing the capabilities of law enforcement agencies across Latin America and the Caribbean to combat organised crime.

This collaboration is part of the broader Alliance for Security, Justice, and Development, a regional initiative launched in December 2024 to address the multifaceted challenges posed by transnational criminal networks.

-

TRADE FINANCE

May 2025

What is a "Red Clause Credit"?

Advance payment credits were traditionally known as "Red Clause Credits".

This was due to the fact that the clause referring to the advance payment was typed in red on the letter of credit.

-

Trade Finance

May 2025

Guess the word

Hint: A document (Bill of __________) often required in trade transactions that confirms the ownership and shipment of goods.

-

TRADE FINANCE COMPLIANCE

May 2025

TBML set to increase in the wake of tariff wars says financial crime advisor

Trade-based money laundering (TBML) is experiencing a resurgence, fuelled by escalating tariff wars and a global shift towards protectionism, according to Hassan Zebdeh, financial crime advisor at compliance and payments solutions provider Eastnets.

He warns that these geopolitical dynamics are creating fertile ground for illicit financial activities that exploit the complexities of international trade.

-

TRADE FINANCE COMPLIANCE

May 2025

US indictments underscore complexities of TBML schemes and importance of vigilant monitoring

Three individuals – brothers Nasir and Naim Ullah from South Carolina, and Puquan Huang from Georgia – have been indicted in the US for orchestrating a trade-based money laundering (TBML) operation that laundered over US$30 million in drug proceeds.

This case underscores the complexities of TBML schemes and the importance of vigilant financial monitoring to detect and prevent such illicit activities.

-

TRADE FINANCE

May 2025

Singaporean national allegedly used forged documents and fraudulent L/Cs in US$1 million international trade fraud

The Economic Offences Wing (EOW) of the Delhi Police has arrested a Singaporean national, Mukesh Gupta, for orchestrating an international trade fraud involving forged shipping documents and fraudulent letters of credit (L/Cs), resulting in a loss of approximately 10 crore rupees (US$1.18 million) to an Indian company.

Read More -

TRADE FINANCE

May 2025

Libya's central bank appoints K2 to address L/C corruption and mismanagement

The Central Bank of Libya (CBL) has appointed the American advisory firm K2 Integrity to monitor its financial transactions, particularly focusing on letters of credit (L/Cs).

Read More -

TRADE FINANCE

May 2025

Bogus chief compliance officer used standby L/Cs in US$4 million fraud scheme

A man who posed as the chief compliance officer of Manhattan's fictitious 'Dominion Bank and Trust Co.' has pleaded guilty to participating in a US$4 million fraud scheme.

Read More -

TRADE FINANCE COMPLIANCE

May 2025

What is a boycott?

A boycott is a voluntary abstention from social or economic dealings with a person, entity, or country, designed to force them to alter objectionable behaviour.

The term ‘boycott’ is also used to refer to actions mandated by governments against other countries or private entities.

IN PRACTICAL TERMS

In practical terms, a boycott imposed by law is an embargo, often described as a sanction.

What does it mean then when we talk about ‘Anti-Boycotts? -

Trade Finance Compliance

May 2025

Guess the word

Hint: Money laundering technique where a seller sends an invoice, but no goods are shipped - __________ shipment

-

TRADE FINANCE COMPLIANCE

April 2025

Trump’s tariff policies raise TBML risks in several ways

Tariff policies introduced by US President Donald Trump have the potential to inadvertently increase the risk of trade-based money laundering (TBML) for several reasons

The tariff policies, by increasing complexity and incentivising evasive practices, mean that enhanced vigilance, regulatory oversight, and transparency measures become essential to mitigate these unintended consequences.

-

TRADE FINANCE COMPLIANCE

April 2025

Bill to combat TBML and other criminality in foreign free trade zones introduced by US senator

US Senator Bill Cassidy has introduced the Containing and Limiting the Extensive Abuse Noticed in Free Trade Zones Act (Clean FTZ) to create a trade rating system based on US and international standards to combat trade-based money laundering (TBML) and other criminal activities in foreign FTZs.

The Republican senator says that currently, no formal rating system for FTZs exists, making it challenging for federal enforcement authorities to address illegal trafficking of illicit narcotics, persons, weapons, tobacco, counterfeits, commodities, wildlife, and more.

-

TRADE FINANCE COMPLIANCE

April 2025

India’s gold and silver traders face advance remittance restrictions or L/C terms to tackle TBML

The Reserve Bank of India’s (RBI) has proposed draft regulations under the Foreign Exchange Management Act (FEMA) to introduce measures, including requirements for gold and silver traders to deal on advance remittance restrictions or letter of credit (L/C) terms.

If implemented, the regulations could significantly impact trade-based money laundering (TBML) schemes involving those precious metals.

-

Trade Finance

April 2025

What is a Revolving Letter of Credit?

A revolving credit is one that allows the amount to revolve on the same terms and conditions as the original letter of credit, following the occurrence of an event that will 'trigger' a revolvement.

By using a revolving credit, the applicant and beneficiary can agree on the structure of a single credit; determine the base amount of each revolvement and the number of revolvements that are required to fulfil the total value of the contract.

Main features

- Revolvement occurs on an automatic or non-automatic basis

- Revolvement is cumulative or non-cumulative.

-

TRADE FINANCE

April 2025

Ship recycling stymied by L/C difficulties and sanctions on Russia's shadow fleet

Two ready for recycling very large crude carriers (VLCCs) are currently anchored off the coast of Chattogram, Bangladesh, facing delays in their sale to ship recyclers due to complications involving letters of credit (L/Cs) and international sanctions.

Read More -

TRADE FINANCE COMPLIANCE

April 2025

What is Money Laundering?

Money laundering is the criminal practice of processing illegally obtained money by placing it into legitimate finance in order to make it appear as though it were derived from legitimate activities.

FATF defines trade based money laundering as “the process of disguising the proceeds of crime and moving value through the use of trade transactions in an attempt to legitimise their illicit origin.”

Often, trade based money laundering schemes rely on the complexity of global trade as a means of obscuring the true origin of the funds.

There is no “one size fits all” approach to prevent and stop trade based money laundering (Anti Money laundering)

Find out more -

TRADE FINANCE

April 2025

AfDB approves US$25 million facility to improve L/C availability in Madagascar

The African Development Bank (AfDB) has approved a US$25 million trade finance Transaction Guarantee Facility (TGF) that includes letter of credit (L/C) support for Bank of Africa Madagascar (BAM), and aims to accelerate the island's industrialisation and support local businesses.

Read More -

TRADE FINANCE

April 2025

L/C processing and management little changed, but surrounding ecosystem has evolved and continues to evolve rapidly

While letter of credit (L/C) processing and management workflows have remained largely unchanged for decades, the surrounding ecosystem has recently undergone significant transformation, according to an article written by Amey Prabhu.

Read More -

Sustainability

April 2025

Megatrend - Population Growth

According to the United Nations the world's population is expected to increase by more than 30 percent to upwards of 9 billion between now and 2050.

A large proportion of this population increase will occur in the world's less developed regions, including those in Africa, Asia and Latin America.

Key factors behind the continuing population growth in less developed regions are lower rates of infant mortality and greater life expectancy thanks to improved standards of living. Future populations will therefore be larger and older.

-

Trade Finance

April 2025

Crossword

-

TRADE FINANCE COMPLIANCE

March 2025

Exempting US companies and persons from beneficial ownership information reporting raises concerns

In line with US President Donald Trump’s deregulatory agenda, the US treasury department’s Financial Crimes Enforcement Network (FinCEN) has issued an interim final rule removing the requirement for US companies and US persons to report beneficial ownership information (BOI) under the Corporate Transparency Act (CTA).

The move follows the treasury department’s statement that it would not enforce penalties or fines associated with the BOI reporting rule against US citizens or domestic reporting companies.

-

TRADE FINANCE COMPLIANCE

March 2025

Microsoft explains how AI captures TBML in L/C transactions

Operational efficiencies in letter of credit (L/C) processing can be greatly enhanced with AI according to tech giant, Microsoft in a blog that summarises how trade finance is now undergoing rapid and fundamental change, thanks to the advent of cloud and AI technologies.

These technologies can also help detect trade-based money laundering (TBML) in L/C transactions, Microsoft’s director of business development, financial services, Peter Hazou, explains in the blog.

-

TRADE FINANCE

March 2025

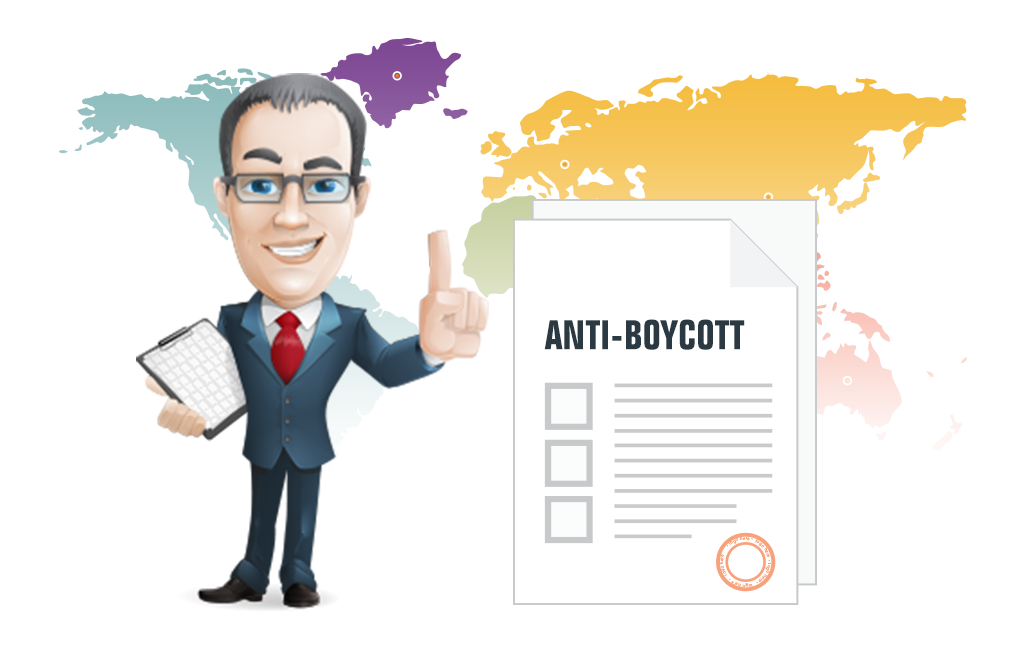

Types of Supply Chain Finance

At a high-level, supply chain financing can be categorised and defined as:

- Receivables Purchase

- Advanced Payables and

- Loans …

with various established and evolving SCF techniques offered under each category.

Read More

Read More

-

TRADE FINANCE COMPLIANCE

March 2025

Indicators of Trade Based Financial Crimes

There are widely accepted Indicators of financial crime that suggest the possibility of various types of financial crime.

Some Indicators are more commonly linked to specific financial crimes whereas others relate to virtually all types.

The behaviour patterns that are commonly associated with financial crime are potential signs or signals that indicate that further scrutiny is warranted.

While the presence of an Indicator does not necessarily mean that a financial crime is being committed, it does signal the possibility and the greater the number of Indicators present, the greater the possibility that there is a financial crime and, in any event, the greater the need for additional scrutiny

Find out more -

TRADE FINANCE COMPLIANCE

March 2025

ADB reports on the efforts of FIUs of five Asian countries to counter TBML

The Asian Development Bank (ADB) has filed a report on its collaborative pilot initiative involving the United Nations Office on Drugs and Crime (UNODC) and the financial intelligence units (FIUs) of five Asian countries to counter trade-based money laundering (TBML).

The pilot has demonstrated the power of data-driven approaches and enhanced partnerships in combating the elusive threat of TBML, according to the director of the ADB’s trade and supply chain division, Steven Beck.

-

TRADE FINANCE

March 2025

L/Cs help compromise Trump's efforts to halt US development aid payments

US President Donald Trump's efforts to suspend US development aid payments pending a comprehensive review have been compromised by financial obligations, including letters of credit (L/Cs), that have already been entered into by the United States Agency for International Development (USAID).

Read More -

TRADE FINANCE

March 2025

New ICC paper published under Digital Library: Consolidated ICC guidance on the use of sanctions clauses in trade finance-related instruments subject to ICC rules

This document contains the Guidance Paper on the Use of Sanctions Clauses in Trade Finance-related Instruments Subject to ICC Rules (2014) and the Addendum to Guidance Paper (2020)

You can read the paper here

-

Supply Chain Finance

March 2025

Crossword

Test you knowledge on Supply Chain Finance.

-

TRADE FINANCE COMPLIANCE

February 2025

FATF agrees to clarify risk-based approach standards

The Financial Action Task Force (FATF) has taken steps to clarify its standards on its risk-based approach (RBA), aiming to enhance the effectiveness of global anti-money laundering and counter-terrorist financing (AML/CFT) measures.

The risk-based approach is a cornerstone of the FATF framework, requiring countries, financial institutions, and other regulated entities to assess and address risks proportionately.

-

TRADE FINANCE

February 2025

BCR launches World Supply Chain Finance Report 2025: Global SCF volumes up 8%

BCR proudly announces the launch of the World Supply Chain Finance Report 2025 (WSCFR25), a definitive resource offering unparalleled insights into the evolving landscape of global supply chain finance (SCF). Edited by Michael Bickers, the report examines key trends, regional performance metrics, and emerging challenges, providing a holistic view of the sector's trajectory amid economic shifts, digital transformation, and growing ESG priorities.

Read More -

TRADE FINANCE COMPLIANCE

February 2025

AfDB’s three-year plan for AML and to combat IFFs to launch online on 25 February

The African Development Bank (AfDB) says it will launch through an online event on 25 February 2025 its new three-year plan for initiatives to promote anti-money laundering (AML) activities and combat illicit financial flows (IFFs).

The event to unveil the bank’s Action Plan for Anti-Money Laundering and Combating Illicit Financial Flows (2024-2026) will bring together experts to discuss practical solutions for protecting Africa’s financial resources from criminal activities.

-

TRADE FINANCE COMPLIANCE

February 2025

Major international money laundering network using TBML dismantled by Dubai authorities

Dubai authorities have dismantled two major international money laundering networks, one of which employed trade-based money laundering (TBML) techniques.

Collectively, the networks are responsible for processing illicit funds exceeding 641 million UAE dirham (AED641 million – US$175 million).

-

TRADE FINANCE

February 2025

L/C difficulties help drive ship recycling to lowest point since 2005

Lloyd's List Intelligence has reported that ship recycling levels in 2024 reached the lowest point since 2005. The decline was driven by several interconnected factors, including increasingly difficult economic, financial, and regulatory environments.

Read More -

Trade Finance

February 2025

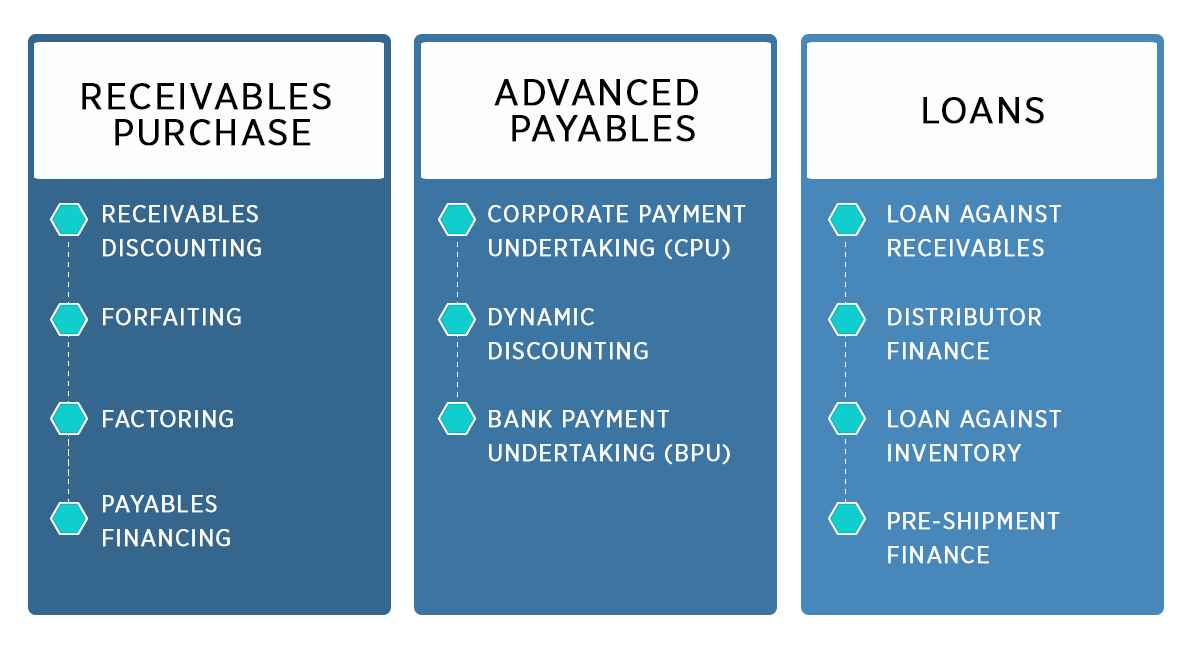

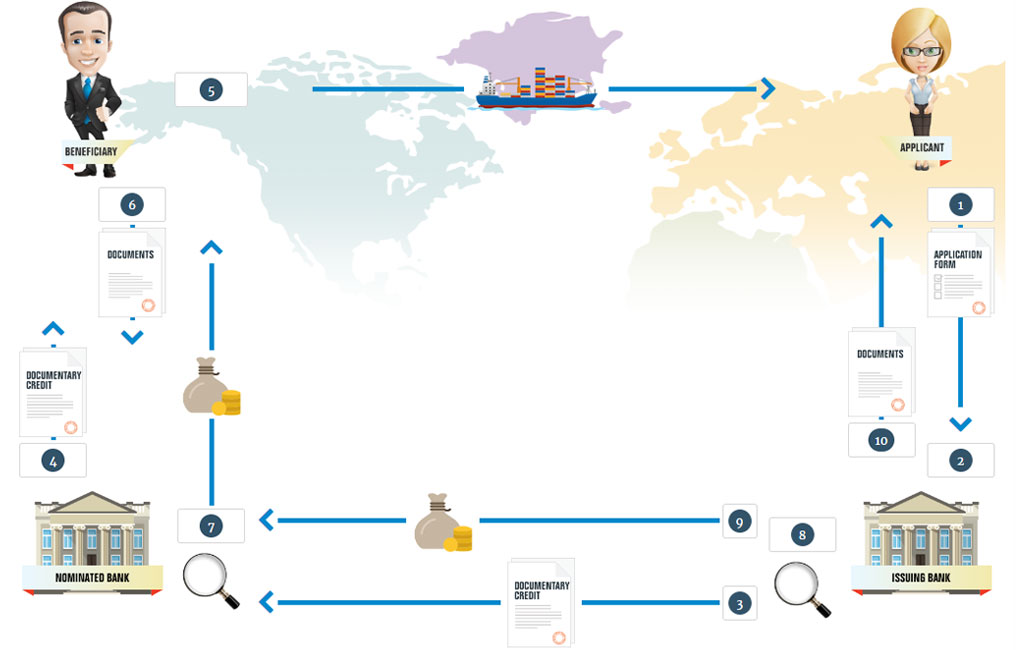

Documentary Credit Cycle

A typical credit cycle follows 10 basic steps.

- The importer, known as the applicant, applies to the issuing bank to issue a documentary credit in favour of the exporter, known as the beneficiary.

- The issuing bank reviews the application form to ensure that it is complete and precise and that it satisfies internal credit approval.

- If satisfied with the application, the issuing bank issues the documentary credit and forwards it to the advising bank.

- The advising bank satisfies itself as to the apparent authenticity of the credit and forwards it to the beneficiary.

- The beneficiary examines the documentary credit to ensure that he can comply with its terms and conditions. If not satisfied with the terms of the credit the beneficiary will seek an amendment.

- When the beneficiary determines that the credit is acceptable, he ships the goods and makes a presentation of the documents to the nominated bank. It is very common that the advising bank is also the nominated bank.

- The nominated bank examines the documents against the terms and conditions of the documentary credit and may make settlement as specified in the credit, if they are found to comply. The nominated bank is not obliged to make settlement against a complying presentation unless it has added its confirmation to the credit.

- The documents are then forwarded by the nominated bank to the issuing bank. As the issuing bank has given its definite undertaking to pay the beneficiary, it too is required to examine the documents to determine whether or not they comply with the terms and conditions of the documentary credit.

- If the issuing bank determines that the documents comply, they will reimburse the nominated bank in the manner specified in the documentary credit or as requested in the document schedule of the nominated bank.

- The final step of the cycle involves the issuing bank obtaining reimbursement from the applicant, usually by debiting the applicant’s bank account. The issuing bank then releases the documents to the applicant to enable them to take possession of the goods.

-

TRADE FINANCE

February 2025

A protocol for digital trade: Experts unveil plan to tackle fragmentation

A group of trade and technology veterans have set out plans to develop an open-source protocol that bridges gaps between different platforms, banks, buyers, sellers and other parties seeking to digitalise trade.

The project will be undertaken by the Verifiable.Trade Foundation (VTF), a Basel-headquartered organisation formally launched this week.

Read More -

Trade Finance

February 2025

Guess the word

Hint: Providing monies to a supplier upfront.

-

TRADE FINANCE COMPLIANCE

January 2025

INTERPOL’s new Silver Notice to significantly bolster the fight against trade-based financial crime

The International Criminal Police Organisation (INTERPOL) has published its first-ever Silver Notice to help trace and recover criminal assets, combat transnational organised crime and enhance international police cooperation.

The notice, requested by Italy, seeks information on the assets belonging to a senior member of the mafia.

-

Sustainability

January 2025

Water Resources

As the world population expands, so does the need for fresh water and safe drinking water supplies. Understanding the water footprint of a product and being able to substitute different types (qualities) of water used in the production of that product contributes towards conserving the natural resources.

The Oil, Paper and Fashion industries are the largest consumers of water globally.

The table below shows the typical volume of water needed to produce a unit of everyday produce.

Commodity (Kg) Volume of water

required (Litres)Tobacco 2,925 Beef 16,000 Potatoes 287 Wine(litre) 870 1 cup of coffee 140 -

TRADE FINANCE

January 2025

Russian grain exporters tell Egyptian buyer they would prefer to continue doing business on L/C terms

Egypt's new commodities importer has asked Russian grain exporters to come up with ways to reduce transaction costs on wheat deals, according to Dubai-based publication Asharq Business.

Read More -

Trade Finance Compliance

January 2025

What’s an Economic Sanction?

An Economic Sanction is the deliberate limitation or cessation of trade and financial relations by a nation or intergovernmental body against a specified nation, region, government, industry, group, or person as a response to, or in an effort to, alter social, political, economic, or military policy.

Sanctions exert pressure on persons, organisations, or political regimes to comply with the law or policy of the state or the organisation imposing the sanctions.

Economic sanctions can be divided into two subsets:

- Financial or

- Trade-based restrictions.

-

TRADE FINANCE

January 2025

New Opinions from the ICC Banking Commission

The latest ICC Opinions from the Banking Commission Meeting held in November 2024 are now available under the Trade Finance Channel of the Digital Library:

- TA947rev

- TA948rev

-

TRADE FINANCE COMPLIANCE

January 2025

Egmont Group publishes report examining the role of FIUs in national risk assessments

The Egmont Group of Financial Intelligence Units (FIUs) has published a report examining the role of its members in the development of National Risk Assessments (NRAs).

Entitled The Role of FIUs in the National Risk Assessment Process, the report says FIUs are central to the development of national anti-money laundering and counter financing of terrorism (AML/CFT) strategies, and emphasises that they are central in the fight against money laundering and terrorist financing (ML/TF).

-

Trade Finance

January 2025

Guess the word

Hint: The seller/exporter in a letter of credit.

-

TRADE FINANCE COMPLIANCE

December 2024

UK’s financial regulator “incompetent at best, dishonest at worst”

A cross-party interest group of British members of parliament and peers has published a damming report on the UK’s principal financial regulator, the Financial Conduct Authority (FCA).

The FCA plays a significant role in ensuring that financial institutions in the UK identify and combat trade-based financial crime (TBFC). Its involvement in the financial sector is multi-faceted, including regulatory oversight, guidance, enforcement, and collaboration with other stakeholders.

-

TRADE FINANCE

December 2024

QIIB launches Qatar's first digital L/C platform

Qatar International Islamic Bank (QIIB) has announced the launch of its digital letter of credit (L/C) platform that eliminates the need for customers to visit the bank.

Read More -

Trade Finance

December 2024

Guess the word

Hint: The seller/exporter in a letter of credit.

-

SUSTAINABILITY

December 2024

Population Growth and Rise of the Middle Classes and Urbanization

According to the United Nations the world's population is expected to increase by more than 30 percent to upwards of 9 billion between now and 2050.

Trade Finance

December 2024

What is a Clean Standby LC?

A clean standby is an undertaking to pay on presentation of a simple demand or draft without any reference to the occasion for drawing it.

Due to the simplicity of its requirements - merely a demand or a draft - a clean standby is sometimes known colloquially as a “suicide standby”.

TRADE FINANCE COMPLIANCE

December 2024

Opportunities for the US and India to collaborate in efforts to tackle trade-based financial crime

India and the US could deepen their collaborative efforts to counter trade-based money laundering (TBML) according to international trade, logistics, and inclusion specialist, Nikita Singla.

In a policy memo published by the Stimson Center, a non-profit think tank based in Washington, she suggests that building on existing bilateral relationships, significant potential exists for further capacity-building initiatives between the US and India.

TRADE FINANCE

December 2024

South Korea's Shinhan Bank eases L/C terms in response to currency weaknesses

South Korea's Shinhan Bank has responded to the weakening of the won and volatile economic conditions by extending the maturity of letters of credit (L/Cs) and providing additional funding for businesses paying for L/Cs.

Read MoreSUSTAINABILITY

December 2024

Changing Global Climate

There is common scientific consensus that the global average temperature is rising at an un-precedented rate.

TRADE FINANCE COMPLIANCE

November 2024

Navigating Sanctions, Dark Fleet Risks, And Financial Crime Update

TRADE FINANCE COMPLIANCE

November 2024

EU attempts to blacklist Russia as a high-risk country for money laundering and terrorist financing will face far-right opposition

The European Union (EU) is contemplating adding Russia to its blacklist of high-risk countries for money laundering and terrorist financing according to the European Commissioner for Financial Stability, Financial Services and Capital Markets Union, Mairead McGuinness.

But the notion of distancing Russia still further than it already is from trade with Europe is expected to face opposition from some quarters, such as Bulgaria’s Rada Laykova of the Europe of Sovereign Nations (ESN) group, who argues that the EU’s policy is “wrong and ideological.”

TRADE FINANCE

November 2024

GM secures its all-electric future by putting up US$625 million in L/Cs and cash for JV with Lithium Americas

Lithium Americas and General Motors Holdings (GM) have entered into a new investment agreement to establish a joint venture (JV) for the purpose of funding, developing, constructing and operating the Thacker Pass lithium project in the US state of Nevada.

Read MoreSustainability

November 2024

Palm Oil

Your bank has a position statement on palm oil that states

The bank will only support transactions involving RSPO certified palm oil and only where the supplier employs RSPO approved supply chain certification mechanisms

What does RSPO certified mean?

Established in 2004, the Roundtable on Sustainable Palm Oil (RSPO) promotes the production and use of sustainable palm oil.

The RSPO has developed a set of environmental and social criteria which companies must comply with in order to produce Certified Sustainable Palm Oil (CSPO). When they are properly applied, these criteria can help to minimize the negative impact of palm oil cultivation on the environment and communities in palm oil-producing regions.

TRADE FINANCE

November 2024

BIS launches Project Aperta to facilitate L/C and other trade financing flows

The Bank for International Settlements (BIS) is launching Project Aperta to explore how to reduce frictions and costs in global finance by enabling seamless cross-border data portability.

Read MoreSustainability

November 2024

Quiz

TRADE FINANCE COMPLIANCE

November 2024

Focus on trade finance vulnerabilities in Singapore’s National Anti-Money Laundering Strategy

Singapore has published its National Anti-Money Laundering (AML) Strategy, which outlines the island nation’s strategic approach to address money laundering (ML) risks, and guides its risk-targeted actions to combat ML amidst rapidly changing risks and criminal typologies.

As one of the world’s busiest trading hubs, Singapore’s strategy takes into account AML vulnerabilities connected with trade finance, and is based on three key pillars: to prevent, detect and enforce.

TRADE FINANCE

November 2024

BIS launches Project Aperta to facilitate L/C and other trade financing flows

Mizuho Bank and Bank of New York Mellon (BNY) and have jointly announced a landmark collaboration agreement for enhanced correspondent bank network connectivity for international trade.

Read MoreTrade Finance

November 2024

Guess the word

Hint: The seller/exporter in a letter of credit.

TRADE FINANCE COMPLIANCE

October 2024

US Port of Savannah revealed as TBML exit point for luxury cars destined for Africa and the Middle East

The Port of Savannah in the US state of Georgia is being used as an exit point for luxury cars to be shipped to Africa and the Middle East in trade-based money laundering (TBML) schemes, according to US customs and border protection officials.

Luxury cars are chosen by criminals to be bought and sold internationally because it gives them the opportunity to use complex international trade networks for money laundering while the third busiest seaport in the US provides plenty of cover for criminal activities.

Trade Finance

October 2024

TRADE FINANCE

October 2024

Executive outlines Microsoft's efforts to help partners develop new L/C solutions

Director of business development for financial services at Microsoft, Peter Hazou, has been explaining how the global technology giant has been working with partners to develop new letter of credit (L/C) and other trade finance solutions.

Read MoreTRADE FINANCE COMPLIANCE

October 2024

Barter and TBML are crucial elements in drug dealing, wildlife trafficking and money laundering

Professional Chinese money laundering networks are using barter and trade-based money laundering (TBML) to divert the proceeds of financial crime generated by Mexican cartels into the legitimate economy according to a senior fellow at the Brookings Institution, Vanda Felbab-Brown.

In one episode of The Killing Drugs, a series of interviews centred on the devastating synthetic opioid crisis in the US and elsewhere, she says that the presence of these Chinese money laundering networks is increasing in the US and in Europe and concludes that the use of goods in some money laundering schemes means that cash never needs to cross international borders.

TRADE FINANCE

October 2024

Nassa Group founder accused of using L/Cs in US$3 million TBML scheme

Founder and chairman of Bangladesh-based Nassa Group, Nazrul Islam Mazumder has been accused of being involved in laundering US$3 million to the US through trade-based money laundering (TBML).

Read MoreTRADE FINANCE

September 2024

Latest Technical Advisory Briefing

Technical Advisory Briefing from the ICC Banking Commission.

Latest Technical Advisory Briefing #11 - Definition of Trade Finance is now available under the Digital Library.

View the briefingTRADE FINANCE COMPLIANCE

September 2024

UAE introduces new AML/CFT/CFP strategy to meet international standards

The UAE has announced its new 2024-27 National Strategy for Anti-Money Laundering, Countering the Financing of Terrorism and Proliferation Financing (AML/CFT/CPF).

The strategy, which is formulated around 11 strategic goals, outlines the legislative and regulatory reforms the UAE is taking to prevent the impact of illegal activities on society.

TRADE FINANCE

September 2024

L/Cs may have been improperly used in scheme to supply Nigeria with substandard Russian fuel

Letters of credit (L/Cs) may have been improperly used in schemes to import substandard fuel, including petroleum products, that originated in Russia but was shipped via Malta and then on to Nigeria.

Read MoreTRADE FINANCE

September 2024

CargoX's digital L/C to feature in partnership with the world's eighth-largest container carrier

CargoX, which features digital letters of credit (L/Cs) as part of its suite of blockchain-based solutions for trade finance, has announced a strategic partnership with HMM, Korea's largest and the world's eighth-largest container carrier.

Read MoreTRADE FINANCE COMPLIANCE

September 2024

African trade dampened by stringent compliance and FATF’s beneficial ownership requirements, Afreximbank responds

Stringent compliance requirements, particularly those related to anti-money laundering and counter financing of terrorism (AML/CFT), are considered to be significantly hampering the expansion of intra-African trade as well trade between Africa and the rest of the world.

In response, the African Export-Import Bank (Afreximbank) is ramping up efforts to enhance African trade, which continues to account for less than 3 per cent of global commerce.

Trade Finance

September 2024

Guess the word

Hint: Draft payable on demand and drawn by or on behalf of the bank itself.

TRADE FINANCE

August 2024

Latest Technical Advisory Briefing

Technical Advisory Briefing from the ICC Banking Commission.

Latest Technical Advisory Briefing #10 - Acceptance or rejection of an amendment, by a beneficiary, under a documentary credit issued subject to UCP 600 is now available under the Digital Library.

View the briefingTRADE FINANCE COMPLIANCE

August 2024

FinCEN issues notice to customers of financial institutions about reporting beneficial ownership information

The US treasury department’s Financial Crimes Enforcement Network (FinCEN) has issued a notice to customers of financial institutions about reporting beneficial ownership information.

The Corporate Transparency Act (CTA) requires certain entities, including many small businesses, to report to FinCEN information about the individuals who ultimately own or control them.

TRADE FINANCE

August 2024

L/Cs feature in the largest standalone battery energy storage financing globally

Australia's Akaysha Energy has announced the closing of a 650 million Australian dollar (A$650 million - US$430 million) debt raise with a group of eleven domestic and foreign banks.

Read MoreTRADE FINANCE COMPLIANCE

August 2024

Singapore amends AML/CFT legislation to facilitate property seizures, align with FATF standards and enhance data sharing

To better tackle money laundering offences, Singapore’s parliament has passed a bill that will give more teeth to city-state’s courts when dealing with properties linked to suspected financial crime.

The bill also aims to bring Singapore’s framework for anti-money laundering and countering the financing of terrorism,(AML/CFT) in line with the Financial Action Task Force (FATF) standards and enable more data sharing between government agencies.

TRADE FINANCE COMPLIANCE

August 2024

Export Controls: HS Codes and Dual Use Goods

The FinCEN and BIS published list of “High Priority Goods” in 2023 relating to the Russian invasion of the Ukraine highlight the need for FIs to dig into transactions to monitor for certain goods. This panel will discuss best practices for compliance.

SUSTAINABILITY

July 2024

Sustainability Reporting & Disclosures

Sustainability factors are becoming a mainstream part of investment decision making with increasing demands for companies to provide globally comparable information on sustainability-related risks and opportunities in their reporting.

TRADE FINANCE

July 2024

Digital identity verification advanced in maritime sector by WaveBL and GLEIF

The Global Legal Entity Identifier Foundation (GLEIF) and WaveBL have announced a new partnership today, which is set to provide fresh opportunities for the global maritime industry to enhance operational efficiency, improve security, and alleviate the burden of regulatory compliance through the digitalisation of electronic Bills of Lading (eBLs) and associated trade documents.

WaveBL, a leading blockchain platform specialising in the digitalisation of trade documents, is expanding its international network to support the swift, effective, and economical distribution of eBLs across the globe.

Read MoreTRADE FINANCE

July 2024

New Opinions from the ICC Banking Commission

The latest ICC Opinions from the Banking Commission Meeting held in July 2024 are now available under the Trade Finance Channel of the

Read MoreTrade Finance Compliance

July 2024

Guess the word

Hint: ___________ Shipment - fraudulent documents presented and no goods actually shipped.

TRADE FINANCE COMPLIANCE

July 2024

Financial institutions to adopt bespoke risk-based AML/CFT approaches under FinCEN’s proposed new rule

The US treasury department’s Financial Crimes Enforcement Network (FinCEN) has proposed a new rule to strengthen and modernise financial institutions’ anti-money laundering and counter financing of terrorism (AML/CFT) programmes.

While financial institutions have long maintained AML/CFT programmes under existing regulations, this proposed rule would amend those regulations to explicitly require that such programmes be effective, risk-based, and reasonably designed, enabling financial institutions to focus their resources and attention in a manner consistent with their risk profiles.

TRADE FINANCE

July 2024

Iran and Russia continue to mull alternative L/C and other financing arrangements

Iran's central bank chief, Mohammad Reza Farzin, is continuing to call for closer financial ties with Russia that would facilitate letter of credit (L/C) and other transactions between Iranian and Russian banks.

Speaking at a congress in St Petersburg organised by Russian monetary policymakers, Farzin is also urging BRICs countries to create their own independent entities to replace the Financial Action Task Force (FATF) and the SWIFT messaging platform.

Read MoreTRADE FINANCE COMPLIANCE

July 2024

Overhaul ‘ineffective’ suspicious transaction reporting says Wolfsberg Group

The Wolfsberg Group has published a paper calling for an overhaul of suspicious transaction reporting as 95 per cent of reports do not lead to prosecutions.

The group does not believe that the value being derived from the constantly increasing volume of suspicious activity reports/suspicious transaction reports (SARs/STRs) is contributing proportionately to effective outcomes in the fight against financial crime.

TRADE FINANCE

July 2024

VPBank and IFC collaborate on $150M SCF for Vietnam's coffee exporters

Vietnam Prosperity Joint-Stock Commercial Bank (VPBank) and the International Finance Corporation (IFC) have jointly provided US$150m in supply chain financing to support Vietnamese coffee-exporting SMEs. This initiative, the first of its kind between IFC and a local bank, aims to integrate these enterprises into the global agricultural supply chain.

The programme will initially fund coffee exporters and later expand to other sectors, enhancing private sector access to global markets. VPBank leverages its SME expertise to offer preferential financing, while IFC connects local suppliers with large international buyers and advises on sustainable finance and supply chain practices.

Read MoreTRADE FINANCE COMPLIANCE

June 2024

New EU sanctions package bans EU banks from Russia’s SWIFT equivalent, restricts LNG trade

The EU has adopted its 14th package of sanctions against Russia for what the West believes is Moscow’s continued unjustified military action in Ukraine. The package strengthens enforcement and anti-circumvention measures.

The new sanctions ban EU banks from using the Russian financial messaging system; restricts shipping related to trade with Russia, and sees the country’s liquefied natural gas exports (LNG) banned for the first time.

TRADE FINANCE COMPLIANCE

June 2024

Wolfsberg Group opposes plan for mandatory enhanced due diligence on FATF grey-listed jurisdictions

A proposal to introduce a mandatory higher level of customer due diligence on customers from countries on the Financial Action Task Force (FATF) grey list of jurisdictions under increased monitoring has been opposed by the Wolfsberg Group.

The association of global banks that aims to develop frameworks and guidance for the management of financial crime risks expressed its opposition to the proposal in its formal response to the UK treasury’s recently launched consultation on improving the effectiveness of the country’s money laundering regulations (MLRs).

Trade Finance Compliance

June 2024

Guess the word

Hint: A stage of Money Laundering.

TRADE FINANCE

June 2024

Successful eBL transactions integrated with digital L/Cs on Surecomp's RIVO trade platform

Surecomp has announced the completion of successful electronic bills of lading (eBL) transactions bringing together multiple parties via its collaborative trade finance platform, RIVO.

Banks can use RIVO as a centralised hub to access all their eBL providers in the same workflow to seamlessly connect their eBLs to letters of credit (L/Cs).

Read MoreTRADE FINANCE

June 2024

Power executives used L/Cs to fraudulently divert funds to their own accounts

India's Enforcement Directorate (ED) is investigating an alleged fraud related to Chadalavada Infratech Limited (CIL) and its executives who are suspected of using letters of credit (L/Cs) to fraudulently obtain the equivalent of US$23 million.

The investigation follows a complaint by State Bank of India (SBI) alleging the siphoning of funds, cheating and criminal conspiracy resulting in loss of public money of the same amount.

Read MoreTRADE FINANCE COMPLIANCE

May 2024

TBML on the rise as innovative technologies support fight against financial crime

Trade-based money laundering (TBML) in the Asia Pacific region (APAC) is still on the rise according to a new research report by Forrester Consulting.

Top Trends Shaping Anti-Money Laundering in Asia Pacific in 2024 builds on Forrester’s

TRADE FINANCE COMPLIANCE

May 2024

Urgent call to action against money laundering and terrorist financing issued by FATF, INTERPOL and UNODC

An unprecedented call to action has been issued by global organisations for countries to urgently step up their efforts to target the huge illicit profits generated by transnational organised crime that facilitate conflicts, fund terrorism, and negatively impact vulnerable populations.

The message from the heads of the Financial Action Task Force (FATF), Interpol and the UN Office on Drugs and Crime says that by focussing on the proceeds of crime and the illicit financial networks behind them, countries can more effectively combat and disrupt organised crime networks and enhance the effectiveness of crime prevention efforts.

TRADE FINANCE

May 2024

Supreme Court of Canada reaffirms fraud exception principle in L/Cs

The Supreme Court of Canada (SCC) has denied leave to appeal the recent ruling by the Alberta Court of Appeal (ABCA) in the case of Pacific Atlantic Pipeline Construction (PAPC) versus Coastal GasLink Pipeline (CGL).

In this ruling, the ABCA refused to prevent CGL from drawing on a letter of credit (L/C) provided by PAPC pending the conclusion of arbitration between the two companies.

Read MoreTRADE FINANCE

May 2024

Anti-boycott advisory could impact on L/C business between the US and Turkey

The US' Bureau of Business and Security (BIS) has issued an anti-boycott advisory regarding Turkey that could impact on letter of credit (L/C) business written between the US and Turkey.

This follows the announcement by the Turkish government to suspend all exports to and imports from Israel until the Israeli government permits an uninterrupted and adequate flow of humanitarian aid into Gaza.

Read MoreIncoterms® 2020

May 2024

About Incoterms

TRADE FINANCE COMPLIANCE

April 2024

Dow Jones unveils AI-powered research platform for due diligence

Dow Jones Risk & Compliance has unveiled a new AI-powered research platform that aims to enable organisations to build an investigative due diligence report covering multiple sources in as little as five minutes.

The risk and compliance subsidiary of global news and business information provider Dow Jones claims the new offering is set to reshape compliance workflows, creating an additional layer of investigation that can be deployed at scale.

TRADE FINANCE COMPLIANCE

April 2024

European Parliament adopts new EU rules to combat money-laundering

The European Parliament has adopted a package of laws strengthening the EU’s toolkit to fight money-laundering and terrorist financing.

The package requires banks and other so-called obliged entities to provide enhanced due diligence measures and checks on customers’ identity while people with a legitimate interest, including journalists and some non-profit organisations, will have access to beneficial ownership registries. Financial intelligence units (FIUs) will be given greater powers.

Trade Finance Compliance

April 2024

Crossword

Test you knowledge on Trade Finance Compliance.

TRADE FINANCE

April 2024

BCR Introduces AI4RF seminar to RFIx24 agenda

Responding to popular demand, BCR has announced the addition of an Artificial Intelligence for Receivables Finance (AI4RF) seminar to its highly anticipated RFIx24 agenda.

Scheduled for May 23rd at Clifford Chance in London, the AI4RF seminar comes as a timely exploration into the potential impact of AI on receivables finance. This event follows the second day of RFIx 2024, providing attendees with an invaluable opportunity to delve into the evolving landscape of receivables finance.

Read MoreSustainability

April 2024

Palm Oil

Your bank has a position statement on palm oil that states

The bank will only support transactions involving RSPO certified palm oil and only where the supplier employs RSPO approved supply chain certification mechanisms

What does RSPO certified mean?

Established in 2004, the Roundtable on Sustainable Palm Oil (RSPO) promotes the production and use of sustainable palm oil.

The RSPO has developed a set of environmental and social criteria which companies must comply with in order to produce Certified Sustainable Palm Oil (CSPO). When they are properly applied, these criteria can help to minimize the negative impact of palm oil cultivation on the environment and communities in palm oil-producing regions.

TRADE FINANCE

April 2024

IFC and DBS launch US$500 million facility to support L/Cs and promote trade flows in emerging markets

The International Finance Corporation (IFC) and Singapore-based DBS have signed a US$500 million facility under the IFC's Global Trade Liquidity Programme (GTLP).

The facility can support letters of credit (L/Cs) and aims to promote capital and trade flows in emerging markets across Asia, Africa, the Middle East and Latin America.

Read More

TRADE FINANCE

April 2024

New sustainability approaches in shipping: Strategies for decarbonising the industry

In an era where environmental concerns are at the forefront of global discussions, the maritime industry, often seen as a major contributor to pollution, is under increasing pressure to adopt sustainable practices.

With approximately 90% of global trade relying on maritime transport, finding ways to mitigate the environmental impact of shipping has become imperative. Fortunately, innovative approaches are emerging, offering hope for a more sustainable future in the shipping industry.

Read MoreTrade Finance

April 2024

Guess the word

Hint: One who represents a principal or who buys or sells for another. A person who is authorised by another to act on his behalf in transactions with third parties.

TRADE FINANCE

March 2024

Latest Technical Advisory Briefing

Just published - Technical Advisory Briefing from the ICC Banking Commission.

Latest Technical Advisory Briefing #9 - "Direct presentation of documents to an Issuing Bank under a documentary credit subject to UCP 600" is now available under the Digital Library.

Incoterms® 2020

March 2024

Incoterms® and Commercial Contracts

The Incoterms® rules explain a set of eleven of the most commonly-used three-letter trade terms, e.g. CIF, DAP, etc., reflecting business-to-business practice in contracts for the sale and purchase of goods.

Trade Finance

March 2024

Crossword

Test you knowledge on ISP98 - Trade Finance.

TRADE FINANCE COMPLIANCE

March 2024

Wolfsberg updates guidance on countering the financing of terrorism

Collective responsibility shared between financial institutions (FIs) and law enforcement agencies amongst other public and private sector actors is central to countering terrorist financing according to the Wolfsberg Group’s newly revised and updated statement on the suppression of the financing of terrorism.

The statement, which replaces one published in 2002, reflects changes in counter financing of terrorism (CFT) measures, the evolving nature of public-private cooperation, and the importance of global cooperation.

Trade Finance Compliance

March 2024

Guess the word

Hint: The essential characteristic of a demand guarantee is that it is ____________ of the underlying transaction that prompted its issuance.

Sustainability

March 2024

GMAP

Tool for assessing agro-commodity risk.

The Global Map of Environmental & Social Risk in Agro-commodity Production (GMAP) is an online service, aligned to the IFC Performance Standards, which collects information on E&S risks for about 250 country commodity combinations and assigns a colour coded risk score (green/red).

The risk score provides a basis for more systematic E&S due diligence and decision-making on financing (go/no go), under the conditions that the applicable standard or certificate is produced.

The GMAP helps users conduct systematic, high-level E&S due diligence associated with trade finance and short-term finance.

Trade Finance Compliance

February 2024

Guess the word

Hint: The seller/exporter in a letter of credit.

TRADE FINANCE

February 2024

Generative AI and LLMs in trade finance: Believe the hype (well, most of it)

If its advocates are to be believed, the technology known as Generative Artificial Intelligence (GenAI) will in due course transform nearly everything we do in the modern world today. And to an extent, since the advent of ChatGPT by OpenAI in November 2022 it already has: entire industries are now managed differently including education, coding and research.

There are as many, if not more examples of where the hype has exceeded the reality of the (lack of) value added. And of course, there have been dangers released in the latest technical revolution, such as breaches of personal privacy, generation of misinformation and malign use by bad actors and autocratic governments (not to mention the threat of the robot apocalypse).

Read More

TRADE FINANCE

February 2024

World Supply Chain Finance Report 2024

The World Supply Chain Finance Report 2024 aims to offer an insight and review of the global supply chain finance market, through both regional and specialist articles contributed by industry experts.

For the purposes of this Report, the term ‘supply chain finance’ has been predominantly used to signify an arrangement whereby a supplier’s invoices are approved by a large buyer for financing by a bank or other financer; also known as reverse factoring, and approved payables finance.

TRADE FINANCE

February 2024

UCP 600 - Exclusions and Modifications

Applicants and issuing banks should be warned that often an article or sub-article contains more than one rule and excluding the article or sub-article removes all the conditions where it may have been the case that only part of the rule was to be excluded.

SUB-ARTICLE 6 (A) AVAILABILITY

A credit must state the bank with which it is available or whether it is available with any bank. A credit available with a nominated bank is also available with the issuing bank.

Sub-article 6 (a) reflects a fundamental and necessary condition in any credit i.e., that every credit must state the bank with which it is available or whether it is available with any bank.

If the issuing bank is seeking to restrict a credit or limit the availability of a credit, the exclusion of the rule does not achieve this. By stating that the credit is restricted to Bank X, the issuing bank excludes the possibility for the credit to be freely available and allows the beneficiary to present documents only to the nominated bank or the issuing bank.

TRADE FINANCE

February 2024

L/C confirmation market set for growth says new research

The global letter of credit (L/C) confirmation market generated US$3.91 billion in 2020. It is projected to generate US$5.09 billion by 2031, and grow at an annual rate of 2.7 per cent between 2021 and 2030, according to a new report published by Allied Market Research.

The report takes a look at the impact of the Covid-19 pandemic on the L/C confirmation market, and analyses leading market players, including Bank of America, Citigroup, DBS Bank, JPMorgan Chase, MUFG Bank, Mizuho Bank, Scotiabank and Standard Chartered.

Read MoreTRADE FINANCE COMPLIANCE

February 2024

Professional money launderers turning to TBML and shell companies to enable illicit financial flows

Professional money launders are on the increase and are using trade-based money laundering (TBML) in their efforts to legitimise illicit financial flows, notably those associated with drug trafficking according to the US treasury department’s 2024 National Money Laundering Risk Assessment (NMLRA).

It outlines a typical case involving a clothing wholesaler based in Paramount in the US state of California, that was ordered to pay nearly US$10.4 million for violating drug trafficking sanctions and for customs fraud.

TRADE FINANCE COMPLIANCE

February 2024

Wolfsberg Group publishes revised guidance on Swift RMA due diligence

The Wolfsberg Group has published updated guidance for Swift Relationship Management Application (RMA) due diligence.

The association of 12 global banks which aims to develop frameworks and guidance for the management of financial crime risks says the changes have been made to keep pace with technical changes occurring as the industry moves to the ISO20022 standard.

TRADE FINANCE COMPLIANCE

January 2024

Egmont Group accepts ‘substantial donation’ from FATF grey-listed UAE

The Egmont Group of Financial Intelligence Units (FIU) has accepted a “substantial donation” from the UAE, which is currently on the Financial Action Task Force (FATF) ‘grey list’ of jurisdictions under increased monitoring.

The donation from the UAEFIU for an undisclosed amount is to help support the Egmont Centre of FIU Excellence and Leadership (ECOFEL) programme.

TRADE FINANCE

January 2024

What is a Clean Collection?

If only financial documents, such as bills of exchange are used in a collection, it is known as a 'Clean Collection' i.e. in a clean collection there are no commercial documents attached to the collection instruction that the exporter delivers to their bank.

Trade Finance Compliance

January 2024

Guess the word

Hint: The term means the offering or acceptance of an undue advantage in exchange for the improper performance of a function or activity.

TRADE FINANCE

January 2024

2024 predictions: What’s in stock for tech for trade, treasury and payments in the year ahead?

Following on from our first predictions article, the incremental gains for credit insurance, trade and supply chain finance, TFG surveyed 9 more industry experts looking at what we might expect for technology for trade, treasury and payments in 2024.

As we ring in the new year, the trade, treasury, and payments is indeed poised for another year of significant evolution.

At Trade Finance Global (TFG), we have gathered insights from industry experts to forecast the developments and challenges these sectors will face in the coming year. Their collective wisdom sheds light on the overarching trends and expected transformations across several key areas.

Read MoreTRADE FINANCE

January 2024

Egypt's L/C shortage prompts firms to sell parts of their businesses

Egypt's struggles to obtain sufficient foreign currency liquidity to establish and maintain a sustainable flow of import letters of credit (L/Cs) has prompted several private and state-owned Egyptian companies to sell parts of their businesses to foreign buyers to access US dollars.

The shortage of foreign currency, exacerbated by commodity price hikes since the Russia-Ukraine war, prompted the authorities working through the central bank to use a range of controls over L/Cs with the aim of shoring up Egypt's foreign reserves.

Read More

SUSTAINABILITY

January 2024

EBRD, EU and UniCredit support green SMEs in Bosnia and Herzegovina

The European Bank for Reconstruction and Development (EBRD) is providing a €7m loan to UniCredit Bank d.d. Mostar in Bosnia and Herzegovina. Funds will be lent through the EBRD’s small and medium-sized enterprise (SME) Go Green programme that is supported by the European Union (EU).

The proceeds will enable UniCredit to continue supporting local SMEs’ investments in green and sustainable technologies. Enhanced access to green finance will support the competitiveness and export potential of local businesses, providing them with opportunities to improve their products and services in line with the highest EU climate, environmental protection and other standards.

Read MoreTRADE FINANCE

January 2024

More African banks sign up for L/C support from development institutions

Two more African banks have signed up for facilities provided by development institutions that guarantee trade finance instruments, including letters of credit (L/Cs).

Agreements with Ecobank Malawi and Bank of Africa Tanzania Limited (BOAT) follow hot on the heels of the African Development Bank's (AfDB's) approval of a US$7 million trade finance transaction guarantee facility for NBS Bank in Malawi (DC World News, 20 December 2023).

Read MoreTRADE FINANCE

December 2023

BAFT publishes new guidelines to stem correspondent banking decline

The Bankers Association for Finance and Trade (BAFT) has released an updated version of its guidelines to help respondents establish and maintain correspondent banking relationships necessary for letter of credit (L/C) amongst other international financial transactions and banking services for other financial institutions.

The BAFT Respondent's Playbook 2.0: A Correspondent Banking Relationship Guide is intended as a roadmap for respondent banks on international anti-money laundering and counter financing of terrorism (AML/CFT) standards.

Read MoreTRADE FINANCE COMPLIANCE

December 2023

Transparency International calls for a harmonised EU approach on beneficial ownership access

One year after an EU court ruling on beneficial ownership registers left civil society and journalists in 13 countries encountering obstacles or completely unable to access information regarding companies’ real owners, Transparency International (TI) has published analysis of how different European states have responded by introducing disparate approaches to beneficial ownership access.

The need for a harmonised approach across the EU is clear, according to the NGO that focuses on combating global corruption.

TRADE FINANCE

December 2023